Pay later. Earn Sparks. Shop smarter.

What is it?

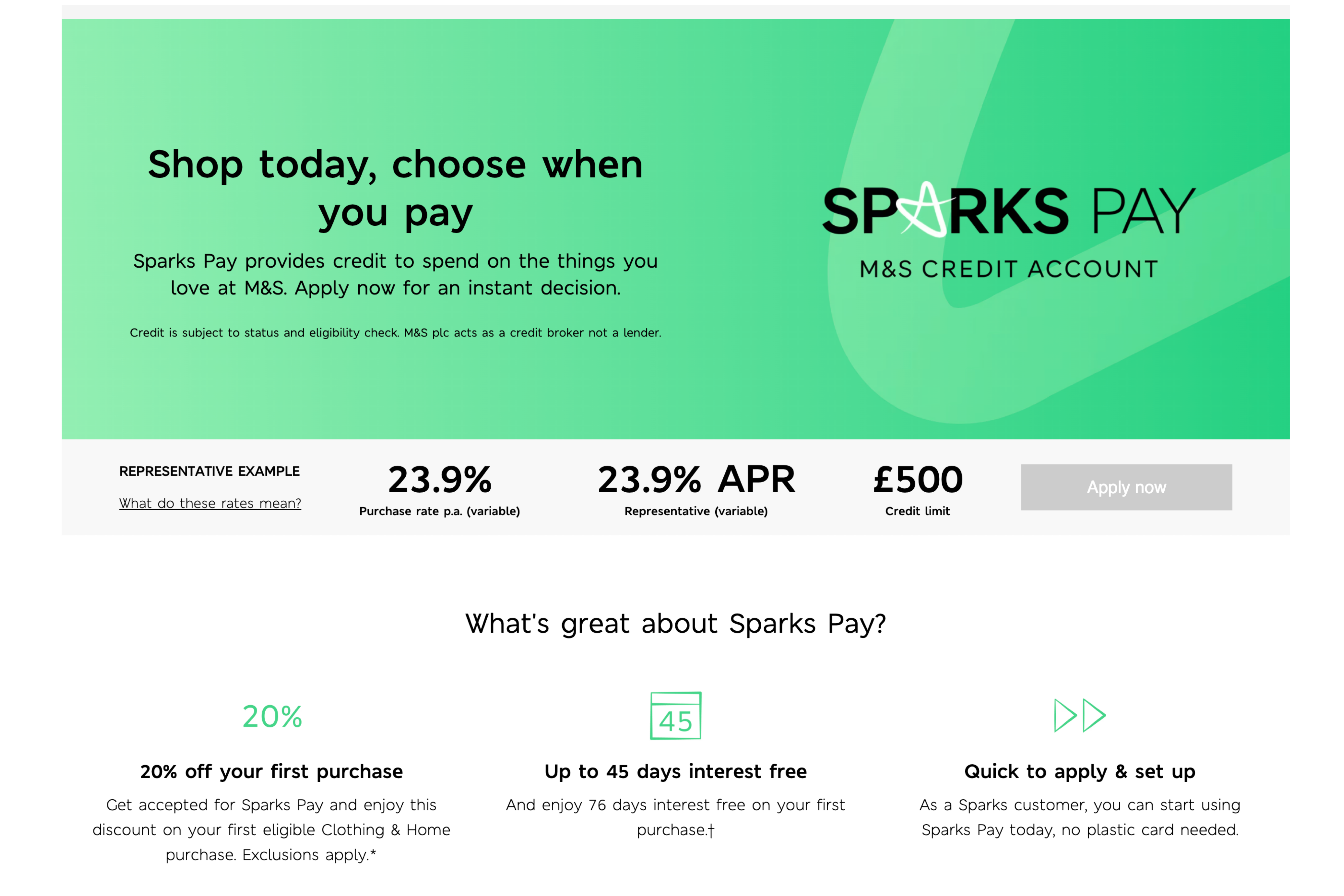

Sparks Pay allows M&S customers to split payments into instalments while continuing to earn Sparks loyalty rewards. Integrated into the checkout journey, it combines flexible payments with personalised benefits—all under the trusted M&S brand.

Journey highlights

-

Sparks Pay appears as a payment option at checkout. No plastic card required

-

Customers apply or activate directly in the M&S site

-

70 days interest free credit & 20% of first purchase

-

45 days interest free credit on additional purchases

-

Continue earning Sparks points on eligible purchases

-

Full visibility of credit and repayment history within the M&S app

Sparks Pay turns flexible credit into a loyalty engine - rewarding shoppers every time they say yes

Why it matters

By embedding BNPL into its existing loyalty ecosystem, M&S creates a value loop - offering financial flexibility while strengthening emotional and transactional loyalty. Sparks Pay makes it easy for customers to say yes to bigger purchases, while keeping them within the M&S ecosystem.