Credit that feels like it’s part of the brand. Because it is.

What is it?

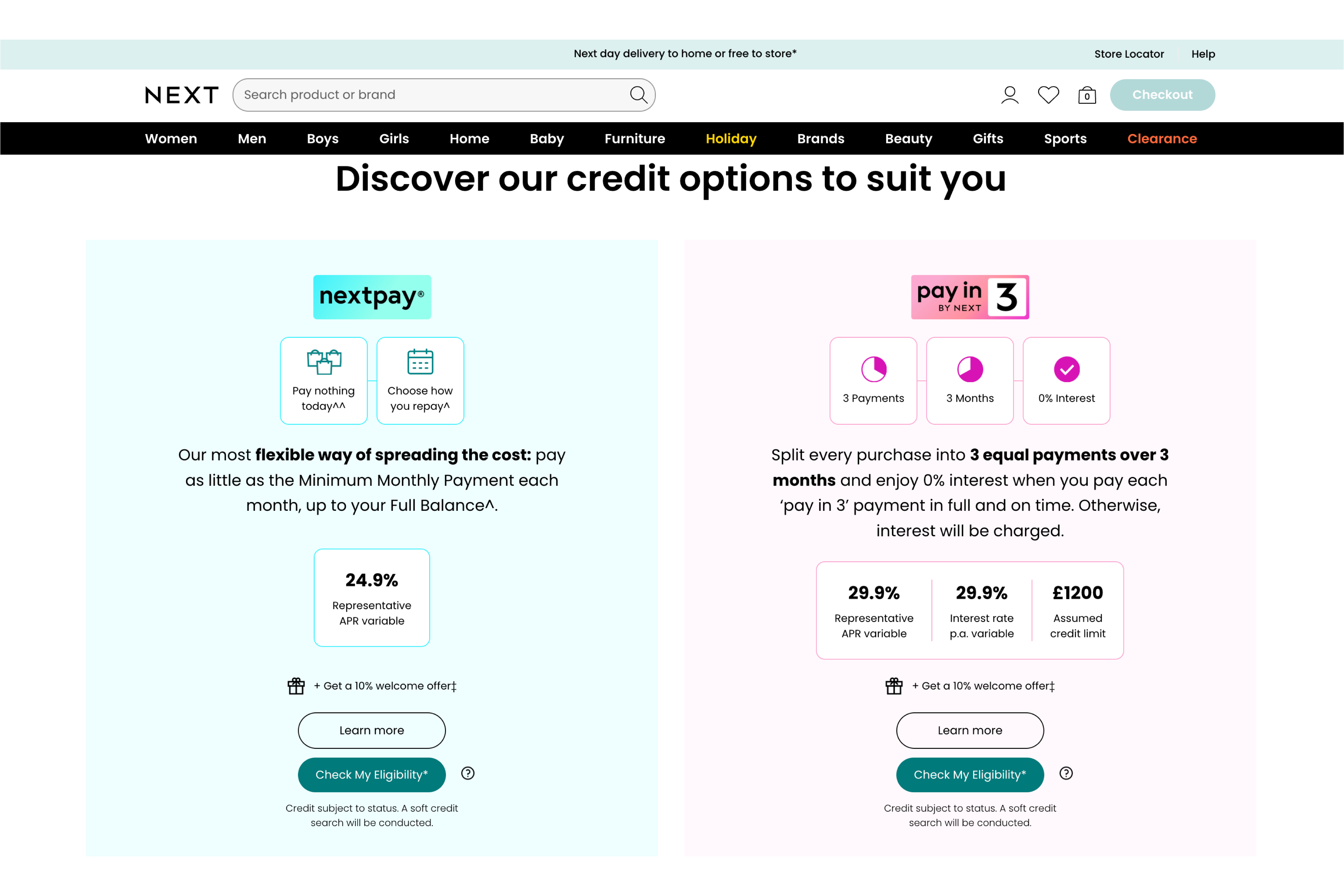

NextPay is Next’s own in-house credit account, giving customers up to 45 days of interest-free shopping on fashion, home, and more. Fully integrated into the Next customer journey and not powered by any third-party BNPL - it’s a true embedded finance product, owned and operated by Next.

Journey highlights

-

Use it to pay on partner sites like Made and Fatface

-

Apply directly during checkout and get an instant decision

-

Shop now, receive a single monthly bill

-

Enjoy added perks like VIP sale access and delivery upgrades

-

Credit experience managed entirely within the Next ecosystem

NextPay doesn’t just offer BNPL - it owns it, turning flexible credit into a seamless brand experience

Why it matters

NextPay combines flexible credit with exclusive benefits - early access to sales, order tracking, and next-day delivery - while keeping full control over the financial experience. Unlike retailers who outsource to Klarna or Clearpay, Next has built its own embedded credit infrastructure, deepening customer loyalty and ownership.